Understanding the Status Certificate & Why It’s Crucial for Condo Buyers

If you’re considering or already in the process of purchasing a condo, you’ve most likely heard of the term ‘Status Certificate’. This document is a vital piece when purchasing a condo as it provides important details on the condominium corporation which should be reviewed before making the big leap to live or buy that specific condo unit.

So, What is a Status Certificate?

A status certificate is a comprehensive document that covers various aspects, including financial status, legal issues, and the rules and regulations governing the condo community.

Key components of a status certificate typically include:

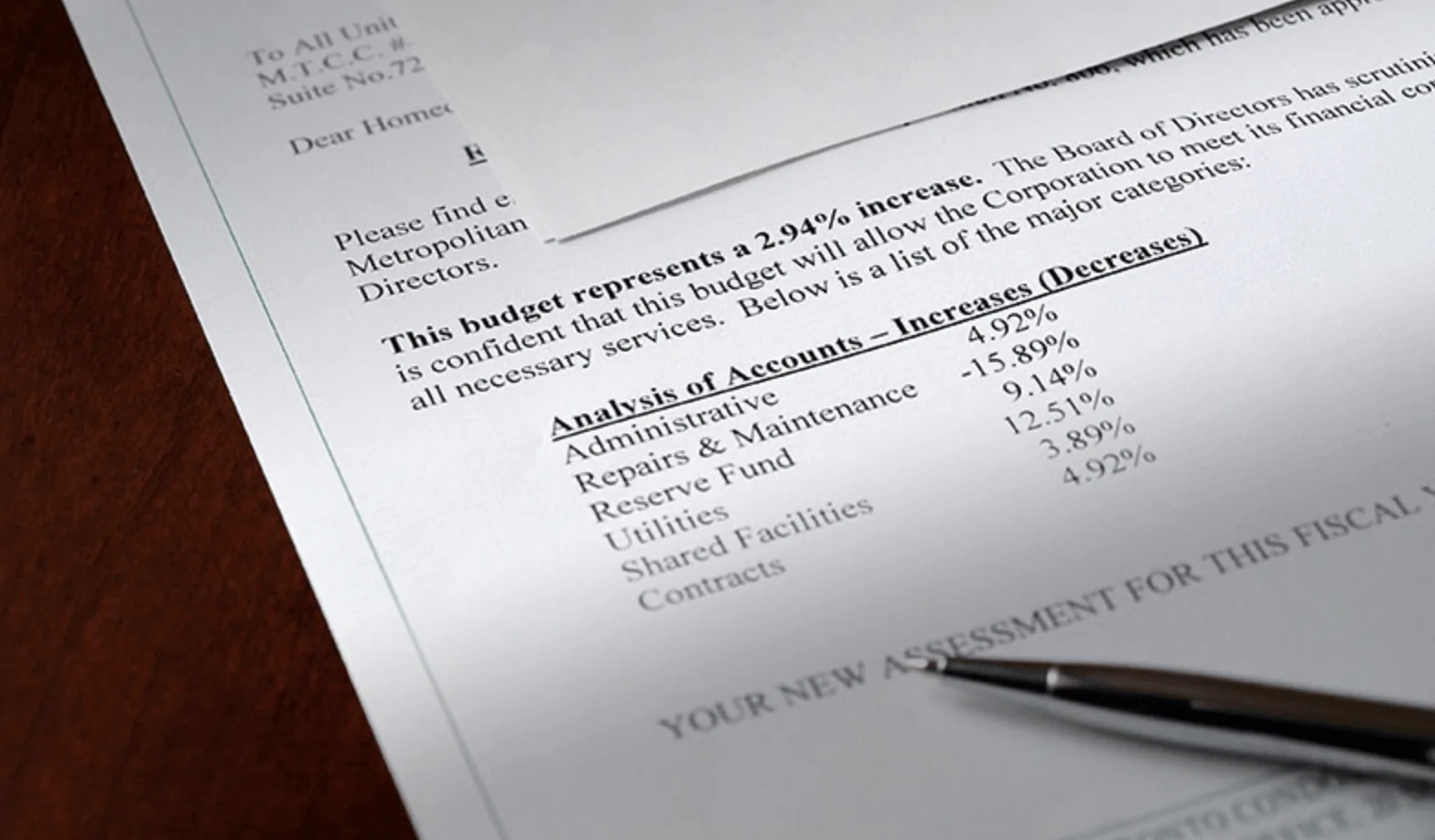

- Financial Information: This section details the unit’s monthly maintenance fees, any outstanding special assessments, and the overall financial health of the condominium corporation, including reserve fund status. This information will entail the future of your maintenance fees.

- Legal Matters: Information about ongoing or pending legal actions involving the condominium corporation is included. This can affect the financial stability and future assessments.

- Rules and Regulations: The document outlines the condominium’s rules and restrictions, such as pet policies, rental restrictions, and common area usage guidelines.

- Insurance Coverage: Details of the insurance coverage held by the condominium corporation, including what is covered and what is not.

- Management Information: Information about the condominium’s management company and contact details.

Why is the Status Certificate Important?

The status certificate plays a crucial role in the condo buying process for several reasons:

- Financial Transparency

One of the most critical aspects of the status certificate is the insight it provides into the financial health of the condominium corporation. It reveals:- Maintenance Fees: Knowing the current maintenance fees helps you understand the ongoing costs of owning the condo. It also provides information on any planned increases in fees.

- Reserve Fund: A well-funded reserve fund indicates that the condominium corporation is prepared for future repairs and maintenance, reducing the risk of unexpected costs.

- Outstanding Special Assessments: These are additional charges levied on unit owners for major repairs or improvements. Knowing about any pending assessments can help you avoid unexpected expenses.

- Legal Protection

The status certificate informs you of any ongoing legal issues involving the condominium corporation. This could include disputes with contractors, legal actions by unit owners, or compliance issues with local laws. Understanding these risks helps protect you from potential legal and financial liabilities. - Understanding Rules and Regulations

The status certificate outlines the rules and regulations of the condominium community. This is crucial for ensuring that the condo aligns with your lifestyle and expectations. For example, if you have pets, you’ll need to know if there are any restrictions on pet ownership. If you plan to rent out the unit, it’s essential to understand any rental restrictions. - Insurance Information

The document provides details about the condominium corporation’s insurance policy. This helps you understand what is covered by the corporation’s insurance and what you will need to cover with your personal insurance policy. Knowing this information can help you avoid gaps in coverage and ensure that you are adequately protected. - Verification of Seller Claims

The status certificate helps verify the claims made by the seller about the condition and status of the condo unit and the condominium corporation. This ensures that there are no hidden surprises or discrepancies that could affect your decision to buy.

How to Obtain and Review a Status Certificate

Obtaining a status certificate is a straightforward process, but it typically requires a formal request and a fee.

- Request the Status Certificate

Usually, your real estate agent will request the status certificate on your behalf from the seller’s real estate agent. - Review the Document Thoroughly

Once you receive the status certificate, review it carefully. We always recommend to have a real estate lawyer go over the document with you to ensure that you understand all the details and flag any foreseeable implications. Pay special attention to:- Financial Statements: Look at the condominium corporation’s budget, financial statements, and reserve fund status.

- Legal Notices: Check for any ongoing or pending legal actions involving the condominium corporation.

- Rules and Regulations: Ensure that the condo’s rules and regulations are acceptable to you.

- Consider the Implications

Evaluate how the information in the status certificate aligns with your financial situation, lifestyle, and future plans. If there are red flags, such as a low reserve fund or pending legal actions, you may want to reconsider the purchase or negotiate better terms.

A status certificate is a critical document for anyone considering the purchase of a condo. We highly recommend reviewing this with a lawyer before submitting a firm offer to ensure buyers are protecting themselves from any potential risks.

If you or someone you know is in the market to buy and would like our top condominium recommendations, feel free to connect with us and we will be happy to share our list of best condos within your preferred area!